Climate Spending Czar

Air Date: Week of September 30, 2022

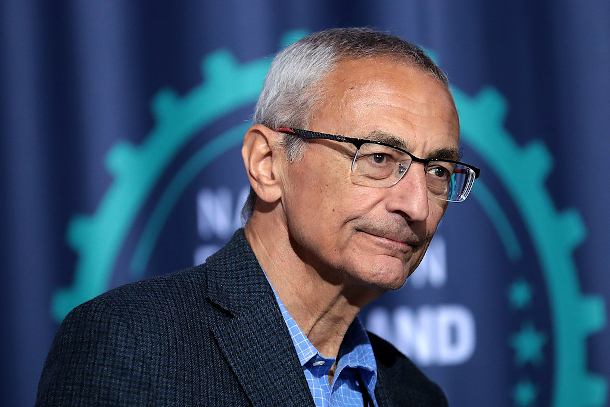

Former White House Chief of Staff John Podesta at the 2019 National Forum on Wages and Working People hosted by the Center for the American Progress Action Fund and the SEIU at the Enclave in Las Vegas, Nevada. (Photo: Gage Skidmore, Wikimedia Commons, CC BY-SA 2.0)

The job of getting the biggest climate bill in U.S. history from concept to action will largely fall to White House veteran John Podesta. As senior advisor to President Biden for clean energy and implementation, he’ll need to coordinate numerous agencies, including the IRS and Treasury, given that around ¾ of expenditures run through the tax code. Harvard economist Joe Aldy joins Host Steve Curwood to explain.

Transcript

BASCOMB: From PRX and the Jennifer and Ted Stanley Studios at the University of Massachusetts Boston, this is Living on Earth. I’m Bobby Bascomb.

And I’m Steve Curwood.

Ultimately it took a year and a half for the core of President Biden’s climate agenda to finally get through Congress, and now the hard of work of putting it into practice begins. The Inflation Reduction Act now allots $370 billion over the next ten years to address the climate crisis, and the job of getting from concept to action will largely fall to White House veteran John Podesta. His official title is now senior advisor to the President for clean energy innovation and implementation. For more about John Podesta and his task, I’m joined now by Joe Aldy, a former colleague and Harvard economist who worked for President Obama on energy and the environment and served on President Clinton’s Council of Economic Advisers. Welcome back to Living on Earth Joe!

ALDY: Hi, Steve, it's good to be here.

CURWOOD: So tell me, what does John Podesta bring to the weighty role that President Biden has tasked him with?

ALDY: Well, President Biden and the Biden administration have a very large law to implement. And I think in bringing in someone like John Podesta, who has a lot of experience -- former Chief of Staff to President Clinton, worked as a senior advisor leading efforts on climate change in the Obama administration as well -- he is someone who has, clearly, the ear of the President. So when he speaks, say, to members of the Cabinet, to say we need to move faster and smarter in implementing the law, people recognize he's speaking on behalf of the President. He's someone who can reach out to stakeholders, to members of Congress, to the public to be able to demonstrate and make the case for what the Biden administration is doing in implementing the law and advancing the President's decarbonization agenda.

Wind turbines in California’s Mojave Desert (Photo: Anthony Quintano, Flickr, CC BY 2.0)

CURWOOD: Now, I have to confess, I haven't read all, what, nearly a thousand pages of the Inflation Reduction Act, but it seems that many of the provisions are related to tax credits. So at the end of the day, of course, Treasury and the IRS are going to be looking at it. What's going on here? And how can John Podesta wrestle with making sure that these tax provisions are implemented?

ALDY: Right, so we have in the Inflation Reduction Act about $370 billion of spending, or what we call tax expenditures. Basically, tax credits for clean energy and climate. About $270 billion of that $370 billion are for tax credits. So there's about 3/4 of climate spending runs through the tax code. And part of that reflects, just historically, we have often used the tax code to subsidize everything from putting solar panels on your roof, to building wind farms, to buying a more energy efficient furnace for your home, or buying an electric vehicle. So a lot of this is extending, although with some important changes, extending the way we've used the tax code in the past. And part of that just reflects the way this bill was crafted under budget reconciliation. Budget reconciliation doesn't give you the opportunity to craft whole new regulatory authorities. It basically has to focus on a way in which we either raise money or spend money. So that's why I think there's a large emphasis here on tax credits. So part of it is that making sure that as John Podesta is organizing the efforts in the federal government, is seeing where there may be opportunities for different parts of the government to assist Treasury and IRS in implementing these new tax provisions. Some of these tax provisions, for example, that are new include giving bonus credits if you build a wind farm, if you can demonstrate that you are satisfying local labor market requirements, the prevailing wage in the local labor market, and you have a labor apprenticeship program. The Department of Labor has helped with those kinds of programs in the past, they may be able to advise Treasury on something like that. There may be cases where the Department of Energy can help advise IRS and Treasury on new technologies to make the case for why they may qualify for specific tax credits. So part of what I think Podesta can do is help IRS and Treasury get smarter, faster, in how they design the guidance and the rules for how they're going to implement these new tax provisions.

CURWOOD: Now, as I understand it, some of the tax credits in this new law are transferable. How's that going to work?

May 2008 photo of John Podesta, left, and President Joe Biden, who was a Senator running for the Vice Presidency at the time. (Photo: Center for American Progress, Flickr, CC BY-ND 2.0)

ALDY: Traditionally, a, say, a wind farm would get in today's terms, about 2.5 cents for every kilowatt hour of electricity that produces. It's a pretty sizable subsidy, and for most wind farm developers, it's more than what they owed Uncle Sam in taxes. And the problem is, if your tax credit is greater than what you owe in taxes, you can't take the full value of the tax credit, you're limited by how much money you owe in taxes. And so typically, in the past, these wind farm developers would partner with a large financial company, like a big bank, a big investment bank that often has large tax obligations every year, tax liabilities. And so that bank would provide equity for the project, and instead of being paid out of revenues, they get paid by being able to claim the tax credits. The challenge is when you're trying to cut emissions so dramatically and drive out really rapid deployment and rapid investment over the next few years, there's a question about whether or not there's enough of that market to meet the needs of wind and solar developers and so on. So instead, in this law, they've said, if you are building a new wind farm, you can sell your tax credit to someone else. And that's going to make it a lot more flexible and a lot easier for the wind farm developer to get that monetary value associated with the power they're producing and sending out onto the grid. So it's something new, I think there may be some challenges in trying to get this market up and running, because you're going to have a bunch of wind farms and solar facilities trying to learn “How do I sell this thing? Who's out there willing to buy it?” And then buyers trying to make sure they understand what it is they're buying. Because with this law, if there's a wind farm producing so many kilowatt hours of electricity, the question of how much that's worth depends on whether they are using domestic manufactured content, like are their turbines made from US-manufactured steel and whether they're satisfying local labor market prevailing wage conditions and apprenticeship programs; whether they've located in a so-called "energy community,” which has traditionally been a fossil fuel community. All these give you larger tax credits, larger value per kilowatt hour of wind that's being produced. So, I think there's gonna need to be a little bit of work to try to figure out how this market will work. It could be a big market, we're talking tens of billions of dollars a year that may transfer through this new approach to tax credits.

CURWOOD: Let's talk a bit about environmental justice here. So often, say, a highly polluting coal fired power plant is upwind from disadvantaged communities. How can a firm that, say, a solar farm goes up and displaces such a thing, how can that solar farm get some credit for helping folks in those communities breathe easier?

ALDY: So part of this is a challenge in how you design policy to target different parts of the country. And there are some provisions some that target energy communities, some that target low-income communities, in the Inflation Reduction Act. But many of the provisions are, in a sense, kind of generic in the sense that they apply nationwide. Now, it may be that as we move forward, we can get a sense of where, if we have a way of sort of collecting the necessary data and analyzing it, at risk of sounding like the public policy wonk that I am, [LAUGHS] like, this is really important; this is really important to get the data and figure it out, and be able to understand that. You know, in some sense that solar facility, if it's going in, it's driving down the price of electricity in the local market. And as a result, it makes it no longer economic for that nearby coal fired power plant to operate. Its benefit is that it is enjoying the value of the tax credits, and it is now generating revenues in the local market. But in a sense, they don't get any sort of additional benefit, if they are reducing, by driving out coal fired power plant, pollution in a nearby community. And I think that is, that is something that may be worth thinking about how we may design the next generation of policies that can do that. You know, this bill has been described fairly as by far the largest energy and climate bill we've ever passed. Yet we also know it's not enough, it's not going to be enough on its own to deliver the President's goal to cut our emissions by at least half by 2030. Or the longer term net-zero goal we have for the economy, we know we'll need to do more. So that's why I think it's important for us to evaluate the performance of these policies. I think that's going to give us the evidence to design much more effective policies in the next round. That'll enable us to think through how to target some of our policies to deliver those benefits to underrepresented communities and low-income populations as well.

The U.S. Treasury Building in Washington, D.C. About three quarters of the expenditures in the Inflation Reduction Act run through the tax code as qualified tax credits that the U.S. Treasury and Internal Revenue Service (IRS) will disburse. (Photo: Ken Lund, Flickr, CC BY-SA 2.0)

CURWOOD: So please, can you give me an example of some of the data that will be very helpful to collect?

ALDY: Right, so let me identify two things. One is with electric vehicle tax credits. We have tax credits both for new vehicles and used vehicles. And so here, IRS is probably gonna have to collect so-called VINs, the Vehicle Identification Number that's unique to every vehicle, so that we know there's not any kind of double-dipping or more of these tax credits. So you can't get it for both buying it new and then buying it used. If we can get that information and also know where you bought the car, that also helps us better understand where EVs are penetrating. It may help us actually be more effective in how we target some of the money in the Infrastructure Investment and Jobs Act that's trying to roll out EV charging stations. It may also help us better understand how those benefits are going to accrue to various communities across the country. The other thing that I think is important is with the subsidies for renewable power. If we just know where these facilities are, and the tax credits that they're claiming, which right now, you don't actually have to put that information when you claim these tax credits in your tax filings. If we just know where they are and how much they're claiming, that's going to enable us to use a lot of our existing tools to understand how that's going to improve air quality across the country.

CURWOOD: There's only, what, two and a half years left in the present administration. How the heck do you get all this done? And by the way, obviously that $370 billion doesn't go out in just these next two years. It's over, what, I think a 10 year period. But how do you get some consistency in this with the possibility the administration could change in a couple of years?

President Barack Obama meets with John Podesta, Counselor to the President, in the Oval Office, Jan. 29, 2015. (Photo: Official White House Photo by Pete Souza)

ALDY: So one thing we've learned even when we have switched administration's in the past, we don't go back and undo tax credits. This is part of the advantage of actually if, when you provide enough subsidy to key economic interests, they will make sure that's not undone. There have been challenges in the past on extending, say, tax credits for wind and solar because they often have sunset provisions, just like they do in this bill, they sunset in a decade. But I, you know there's a sense in which tax credits tend to be durable, even when we see parties change hands. And part of it, too, is the production tax credit for wind was originally a bipartisan deal. Senator Grassley of Iowa is actually quite fond of the tax credit for wind, in part because his home state of Iowa produces a lot of wind power. Also, because by going through the tax code, there's very few opportunities for someone to go to the courts to challenge the tax code, in contrast to how we've thought about courts being used to challenge, say, new regulations issued by federal regulators. Congress doesn't really delegate much discretion to IRS and Treasury in the tax code, they will need to do a little bit in terms of I think, sort of, if you will, the sort of technical design and implementation. But as a result, there's very little for you to hang your hat on to say, “This is something I can challenge in courts.” So I think as a result, a lot of these policies are going to endure over the course of the next decade.

CURWOOD: Joe, to what extent is this Inflation Reduction Act on the scale of a "new deal" for the climate?

Joe Aldy is an economist and professor of public policy at Harvard’s Kennedy School. (Photo: Courtesy of Joe Aldy)

ALDY: So it's a lot more than we've ever done before, and it falls short of what we need. So that's the challenge we face. I know there are some activists who feel like we need a lot more, we needed to spend a lot more. There are some who are frustrated about some of the compromises in this bill, for example, some of what was done with respect to oil and gas leasing on federal lands. I think it depends on what you think the alternative scenario is. For me, the alternative scenario is you don't get any new spending out of this Congress on climate. And in that sense, this is unprecedented. And it's a significant next step on climate policy. But when we think about climate policy, it's not going to be like one big legislative bill, and we've solved the problem. We're gonna have to keep tackling this issue. And we're gonna have to be using all of our authorities throughout the government, we're gonna have to think about ways we partner with state governments and with the private sector, to continue to drive out low carbon technologies, to think about ways we can help people better adapt to a changing climate. There's a lot more that needs to be done. I guess one way to think about it, if you want to draw the analogy to the New Deal, is that in the 1930s, there were actually a lot of pieces of legislation passed over a number of years that constitute what we think of as the New Deal. So I think this is like the first really big piece of legislation in our new sort of climate-oriented deal, if you will, but we're gonna need more as we drive down our emissions, and try to deliver on our goals for 2030 and beyond.

CURWOOD: Joe Aldy is a professor of economics at the Harvard Kennedy School. Joe, thanks so much for taking time with us today.

ALDY: Thanks, Steve. It's been my pleasure.

Links

AP | “Biden picks White House veteran to run revived climate drive”

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Newsletter [Click here]

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea.

Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth