Alaskan Oil Economics

Air Date: Week of January 30, 2015

Deployed in Alaska in 2012, Shell Oil’s Arctic drilling rigs, the Noble Discover and Kulluk, were cited for a series of environmental and maritime violations. (Photo: Day Donaldson; Flickr CC BY 2.0)

Although the Interior Department is offering up new areas for potential fossil fuel leasing, the low price of oil means that new infrastructure may not make economic sense. Energy and investment analyst Joe Stanislaw and host Steve Curwood discuss the Administration’s thinking and oil and gas development prospects.

Transcript

CURWOOD: For years, advocates for the oil industry have pushed to open up the Arctic National Wildlife Refuge for drilling, and it's a top priority for many Republicans, including Lisa Murkowski of Alaska, who now heads up the Senate Energy and Natural Resources Committee.

Murkowski has sharply criticized the President’s bid to expand the wilderness area of ANWR.

But underlying the bluster is a question...with oil priced around $45 per barrel, how much economic sense does it make for oil companies to expand drilling in such a harsh environment?

It’s a question for Joe Stanislaw, an expert on energy and technology investment strategy. Welcome back to LOE.

STANISLAW: Steve, you’re very good to have me.

CURWOOD: So, we understand that the President's call to designate the millions of acres of ANWR as Wilderness effectively takes the coastal plain of ANWR off the oil market if that were to go through. How much sense does it make for oil companies to be expanding drilling in such a harsh financial environment as we have now? Oil is under $50 a barrel.

STANISLAW: I think if you thought about what the President's action means in the very short-term to medium-term from the oil company's perspective, not a whole lot to them. They have no intention of going there anyhow right now given everything that is going on in the oil market. Prices dropping from $100, $110 down to the low $40s. They have other concerns on their mind. And also, they have other low-cost prospects to be developing. Those prospects, if they were in the market or are on the market, we'd be out 10, 15, 20 years for them if they're really thinking about wanting to go there. That's not a short-term area for potential development.

CURWOOD: Talk to me a bit about the oil that is in ANWAR? How much is there, and what would it cost to get it out?

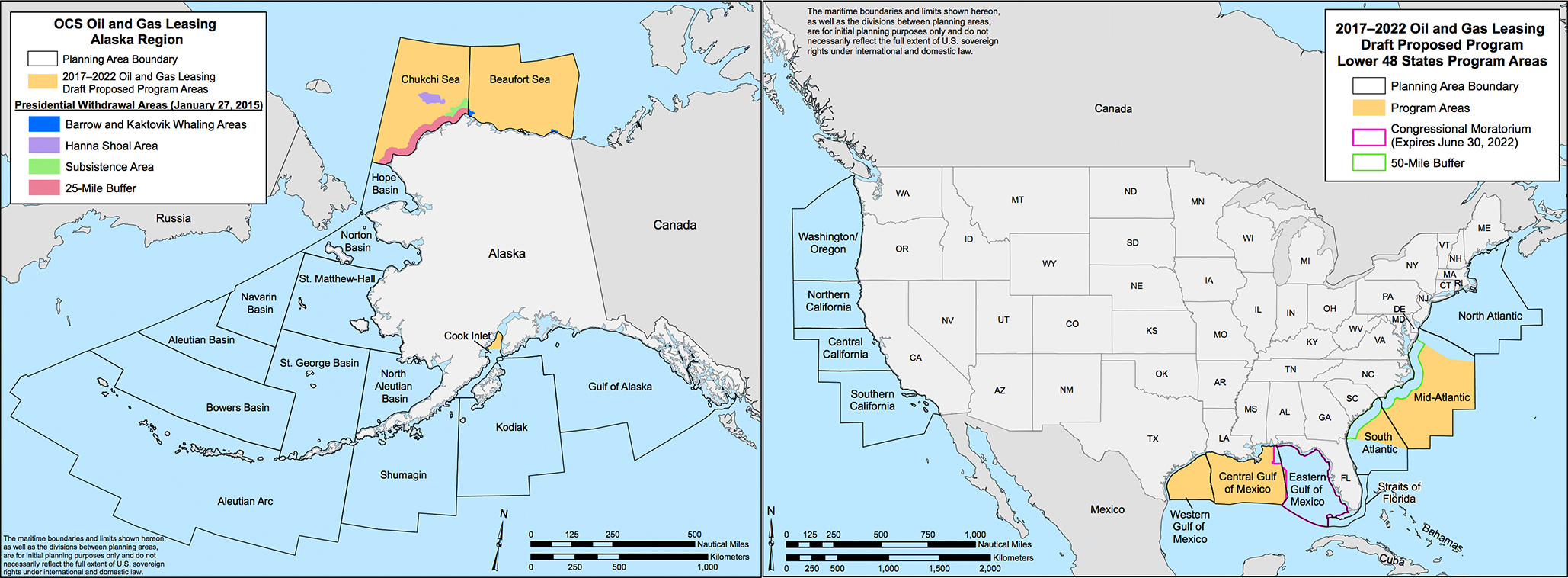

Permissions for offshore oil and gas drilling leases outlined in the draft of the Interior Department’s 5-year plan for 2017-2022. (Photo: Bureau of Ocean Energy Management)

SANISLAW: You know, you ask a very intriguing question. How much oil is there? We don't know. There has been no seismic done which has been off-limits by federal mandate. There have been, I will call them, “informed guesstimates” by a very credible institution called the Energy Information Administration making guesses based on other areas that might look like ANWR to say what resources could look like; how much, is a guess.

CURWOOD: Now at almost the same time the President has said that he's moving to designate much more of ANWAR as Wilderness effectively that will place it off-limits to the oil drilling. He also said that there will be new leases offered for offshore Arctic oil that is in the Arctic Ocean. How interested do you think industry is in that prospect given the hard time that Shell had dealing with the Chukchi Sea just this past year?

STANISLAW: Most of the world’s oil and gas industry look to the Arctic as maybe a potential resource, but in the next few years - five, 10, 15 – it’s sort of - in many people's minds, it's off their minds. I won't call off-limits, but it's not the first thought in their minds. They have seen the challenges Shell has had - some of them unexpected challenges - yes, companies like to think about it, but right now no-one really wants to put a lot of effort into this.

CURWOOD: So, right now, the Hill is battling over Keystone legislation that the President has promised to veto. Looking ahead, how important is this struggle in terms of the oil market?

STANISLAW: I think part of what the President and the administration has done is put out their bones, attractive bones in many ways. The oil and gas industry, the offshore southeast US, for example, is leasing; the Arctic, more leasing in the national reserve, so that when they veto Keystone all the industry won't be mad at them. This is a political issue, and I think he'll veto. And at the end of the day, one has to ask, given everything else that's going on, and the length of time that's been in the works, does it get developed? And the developers must be asking that question too, although they have sunk so much into this they want to have it done, but I think the veto comes into play.

Joseph Stanislaw is a financial adviser on international markets and politics. He is also the co-founder and former president of Cambridge Energy Research Associates, and directs the J.A. Stanislaw Group. (Photo: Courtesy of Joseph Stanislaw)

CURWOOD: So this is more politics then concerns about the oil supply?

STANISLAW: This is definitely about politics, rather than concern about oil supply. I’ll add another dimension, if you'll allow me. I think the big issue here, like so many issues in the United States is federal versus states rights. And I think the real issue that Alaskans are raising is - it should us who has the right to say yes or no, not the federal government. And that's the old-fashioned debate we've had in this country forever. On the one hand, Alaska doesn't agree. But the southeastern states very much agree with what the President's done, which is a line of area that was closed, "stranded", now is open. So they're happy, they don't mind that federal intervention. On the other hand, Alaska says those are our lands that might be developed as our future resource, our future income stream. Should we be the ones that say yes or no to it rather than the federal government? This is the age-old debate in the United States.

CURWOOD: Joe Stanislaw is an expert on energy and investment strategy and the founder the JA Stanislaw Group. Thanks so much, Joe.

STANISLAW: Steve, always a pleasure. Thank you.

Links

Shell to Revive Plans to Drill in Arctic

More about the Oil and Gas Leasing Program

Interior Department Announces its Draft Strategy for Offshore Oil and Gas Leasing

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Newsletter [Click here]

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea.

Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth